Extensive track record

2008

York PE Launched

50+

Investments*

$4bn+

Aggregate Transaction Value

Experienced Team

14

Dedicated Members

200+

Years Cumulative Experience

Transaction Types

York PE has a broad investment mandate and targets various transaction types and structures, including:

- Founders seeking liquidity and the right value-added institutional partner

- M&A roll-up plays in fragmented sectors

- Companies undergoing ownership transitions or recapitalizations

- Growth capital, including minority investments

- Corporate divestitures and carve-outs

FOCUS AREAS

-

Consumer & Wellness

- Consumer products and consumer packaged goods

- Franchisors and franchisees

- Home services and building products

- Leisure and hospitality

- Specialty retail

- Wellness and fitness

Key Themes

- Experiential focus

- Leading consumer brands

- Proven economics

- Growth potential

- Strong secular trends

Curio

Diversified fragrance platform operating a portfolio of leading brands primarily focused on the home fragrance, personal care and home care markets (Minneapolis, MN).

VISIT WEBSITE

The Good Feet Store

A leading franchise retailer and manufacturer of personalized arch supports, compression, and related products, operating 200+ stores across the U.S. and internationally (Carlsbad, CA)

VISIT WEBSITE

Renuity

Direct-to-consumer home improvement services business, specializing in the sale and installation of windows and doors, bathrooms, kitchens, closets, floor coatings and garages across 25+ states (Miami, FL)

VISIT WEBSITE

Supreme Fitness Group

One of the largest Supreme Fitness Group franchisees with 80+ clubs

VISIT WEBSITE

Peachtree Hills Place

An amenity-rich continuing care retirement community for discerning adults (Atlanta, GA)

VISIT WEBSITE

Soccer Post

Soccer Post is the largest local community focused soccer specialty company in the United States. Our stores are designed to provide authentic, best-in-class experiences to each local community we serve.

VISIT WEBSITE*Logos shown reflect the active investments in Fund II and Fund III only.

-

Business & Industrial Services

- Facility Services

- Residential Services

- Distribution Services

- Other Value-Added Services

Key Themes

- Non-core outsourcing and vendor consolidation trends

- Large, fragmented markets ripe for consolidation

- Predictable long-term demand

- Mission-critical services

Cennox

Global managed facility services provider focused on cash automation and self-checkout kiosks (Smyrna, GA & Camberley, UK)

VISIT WEBSITE

Corvia

Fast-growing payment processing company serving specialty ecommerce merchants in the U.S.

VISIT WEBSITE

Renuity

Direct-to-consumer home improvement services business, specializing in the sale and installation of windows and doors, bathrooms, kitchens, closets, floor coatings and garages across 25+ states (Miami, FL)

VISIT WEBSITE

Mode Transportation

Leading non-asset-based provider of third-party logistics services across multiple modes of transportation (Dallas, TX)

VISIT WEBSITE

Cantium

Independent oil and gas company operating in the Gulf of Mexico shelf with more than 300 active wells (Covington, LA)

VISIT WEBSITE*Logos shown reflect the active investments in Fund II and Fund III only.

-

Healthcare

- Multi-site outpatient providers and services

- Facility-based inpatient care and staffing

- Non-facility based care (home health, personal care, home specialty services)

- Physician practice management

- Medical products and devices

Key Themes

- Target systemic cost reduction

- Opportunities for superior clinical outcomes

- Demographic tailwinds

- Reimbursement and reform complexity

AMC Health

Leading provider of remote patient monitoring and virtual care solutions for organizations serving at risk populations (New York City)

VISIT WEBSITE

APT Healthcare

Leading outpatient physical therapy (“PT”) providers in the Mid-Atlantic (Glen Burnie, MD).

VISIT WEBSITE

Healthcare Linen Services Group

A leading provider of linen management services to the healthcare and hospitality industries. HLSG currently operates 14 state-of-the-art laundry processing facilities in four states delivering over 185 million pounds of assorted quality linens into both the healthcare and hospitality markets.

VISIT WEBSITE

Peachtree Hills Place

An amenity-rich continuing care retirement community for discerning adults (Atlanta, GA)

VISIT WEBSITE

Comprehensive Rehab Consultants

One of the country’s leading providers of Physical Medicine & Rehabilitation (Physiatry) and care transitions services to the long-term care market

VISIT WEBSITE

NMA

Neuromonitoring Associates is a Joint Commission-accredited organization dedicated to providing Intraoperative Neuromonitoring (IONM) services. With a focus on quality, we aim to always place patient safety first.

VISIT WEBSITE*Logos shown reflect the active investments in Fund II and Fund III only.

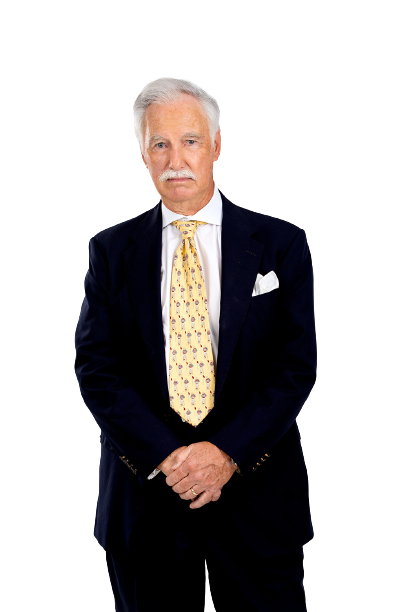

Meet the team

Please see the accompanying disclaimers

Active Portfolio Companies

Healthcare Linen Services Group

A leading provider of linen management services to the healthcare and hospitality industries. HLSG currently operates 14 state-of-the-art laundry processing facilities in four states delivering over 185 million pounds of assorted quality linens into both the healthcare and hospitality markets.

VISIT WEBSITE

APT Healthcare

One of the largest outpatient physical therapy (“PT”) providers in the Mid-Atlantic (Glen Burnie, MD).

VISIT WEBSITE

Curio

Diversified fragrance platform operating a portfolio of leading brands primarily focused on the home fragrance, personal care and home care markets (Minneapolis, MN).

VISIT WEBSITE

AMC Health

Leading provider of remote patient monitoring and virtual care solutions for organizations serving at risk populations (New York City)

VISIT WEBSITE

Cennox

Global managed facility services provider focused on cash automation and self-checkout kiosks (Smyrna, GA & Camberley, UK)

VISIT WEBSITE

Corvia

Fast-growing payment processing company serving specialty ecommerce merchants in the U.S.

VISIT WEBSITE

The Good Feet Store

A leading franchise retailer and manufacturer of personalized arch supports, compression, and related products, operating 200+ stores across the U.S. and internationally (Carlsbad, CA)

VISIT WEBSITE

Renuity

Direct-to-consumer home improvement services business, specializing in the sale and installation of windows and doors, bathrooms, kitchens, closets, floor coatings and garages across 25+ states (Miami, FL)

VISIT WEBSITE

Mode Transportation

Top-10 non-asset-based provider of third-party logistics services across multiple modes of transportation (Dallas, TX)

VISIT WEBSITE

Supreme Fitness Group

One of the largest Supreme Fitness Group franchisees with 80+ clubs

VISIT WEBSITE

Cantium

Independent oil and gas company operating in the Gulf of Mexico shelf with more than 300 active wells (Covington, LA)

VISIT WEBSITE

Peachtree Hills Place

An amenity-rich continuing care retirement community for discerning adults (Atlanta, GA)

VISIT WEBSITE

Comprehensive Rehab Consultants

One of the largest and fastest growing physiatry groups in the United States, providing physiatry, chronic care management and behavioral health services to skilled nursing facilities nationwide (Chicago, IL)

VISIT WEBSITE

NMA

Neuromonitoring Associates is a Joint Commission-accredited organization dedicated to providing Intraoperative Neuromonitoring (IONM) services. With a focus on quality, we aim to always place patient safety first.

VISIT WEBSITE

Soccer Post

Soccer Post is the largest local community focused soccer specialty company in the United States. Our stores are designed to provide authentic, best-in-class experiences to each local community we serve.

VISIT WEBSITEIf you are an investment banker, advisor, business owner, or potential

investor, please contact us at

[email protected].